Updated Information

Categories

Popular

Unlock the Potential of Chiba Prefecture: A Unique Investment in Japan’s Booming Nature Tourism Industry

Others

A guide for foreigners buying real estate in Japan.

Property Knowledge

Essential Knowledge for Property Investment in Japan (Part 1): Understanding Japan’s Earthquake Resistance Standards

Property Knowledge

Captivating Kawazu Cherry Blossoms: Tokyo’s Hidden Cherry Blossom Spots

Exploring Tokyo

【Updated data in 2025】Japan’s Land Prices Continue to Surge, with Tokyo’s 23 Wards Leading the Growth

Market Information

What is 1R, 1K, 1DK and 1LDK

Property Knowledge

【Updated data in 2025】Japan’s Land Prices Continue to Surge, with Tokyo’s 23 Wards Leading the Growth

Land prices in Japan, particularly in Tokyo’s 23 wards, have experienced significant increases in recent years. The latest 2025 data reveals continued growth in both residential and commercial land prices, especially in urban areas. This article explores land price trends across major cities like Tokyo, Osaka, and Nagoya, and analyzes the factors driving these changes. We discuss the influence of housing demand, competition for commercial spaces, and the growth of tourist destinations on land prices, and provide insights into future prospects and investment opportunities in Japan’s real estate market, with a special focus on Tokyo’s 23 wards.

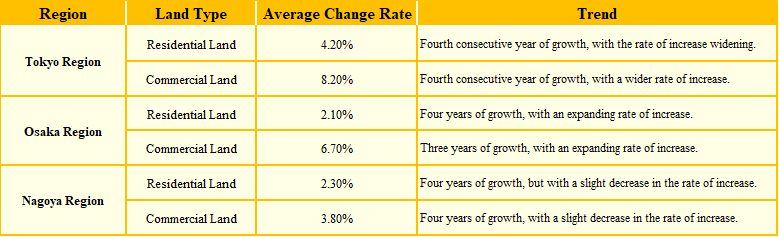

■ National and Regional Land Price Trends in Japan

Recently, Ministry of Land, Infrastructure, Transport and Tourism of Japan Government released its latest land price survey, showing the official land price as of January 1, 2025. According to the survey, average land prices in Japan have increased for the fourth consecutive year across all types of land use, with the rate of increase expanding. In the three major metropolitan areas — Tokyo, Osaka, and Nagoya — both residential and commercial land prices saw steady growth, with Tokyo and Osaka showing continued expansion. Although Nagoya experienced a slight slowdown, the overall upward trend persists.

In local cities, including Sapporo, Sendai, Hiroshima, and Fukuoka, price increases continued, albeit at a reduced pace. However, other regional areas saw a broader rise in land prices, reflecting Japan’s overall economic recovery.

Below is an overview of the land price trends for both residential and commercial properties in the Tokyo, Osaka, and Nagoya regions.

These upward trends highlight the continued strong demand for real estate in both urban and regional markets.

■ Key Trends in Land Prices and the Driving Forces Behind Them

As per the Ministry of Land, Infrastructure, Transport and Tourism, the ongoing increase in land prices across Japan can be attributed to several factors. The land price market has shown significant fluctuations in both residential and commercial sectors. Urban areas, particularly Tokyo and Osaka, have experienced consistent price growth, fueled by steady demand, redevelopment projects, and infrastructure improvements. This overview highlights the key trends, recent developments, and future expectations for land price movements across Japan’s major metropolitan areas.

Residential Land:

- Sustained Demand: The continued low-interest-rate environment has supported strong residential demand, particularly in urban areas like Tokyo and Osaka, leading to ongoing land price increases.

- High Growth Areas: Central areas of Tokyo and Osaka, with excellent transportation and lifestyle amenities, have shown significant price growth.

- Tourist & Resort Destinations: Resort areas and popular tourist destinations have experienced notable price hikes, driven by demand for vacation homes and luxury condominiums from both domestic and foreign buyers.

- Regional Highlights: Okinawa (7.3%) and Fukuoka City (9.0%) have seen the highest increases in residential land prices.

Commercial Land:

- Steady Demand: Major cities have seen consistent demand for retail spaces, hotels, and offices, with low vacancy rates and rising rental prices driving commercial land price increases.

- High Competition Areas: Regions around transportation hubs, where residential and commercial demand intersect, have seen strong price growth.

- Tourism Boost: Areas with rising numbers of foreign and domestic visitors, especially tourist destinations, continue to see high commercial land price growth.

- Redevelopment & Infrastructure: Regions undergoing redevelopment projects have experienced land price increases, driven by expectations of improved convenience and urban vibrancy.

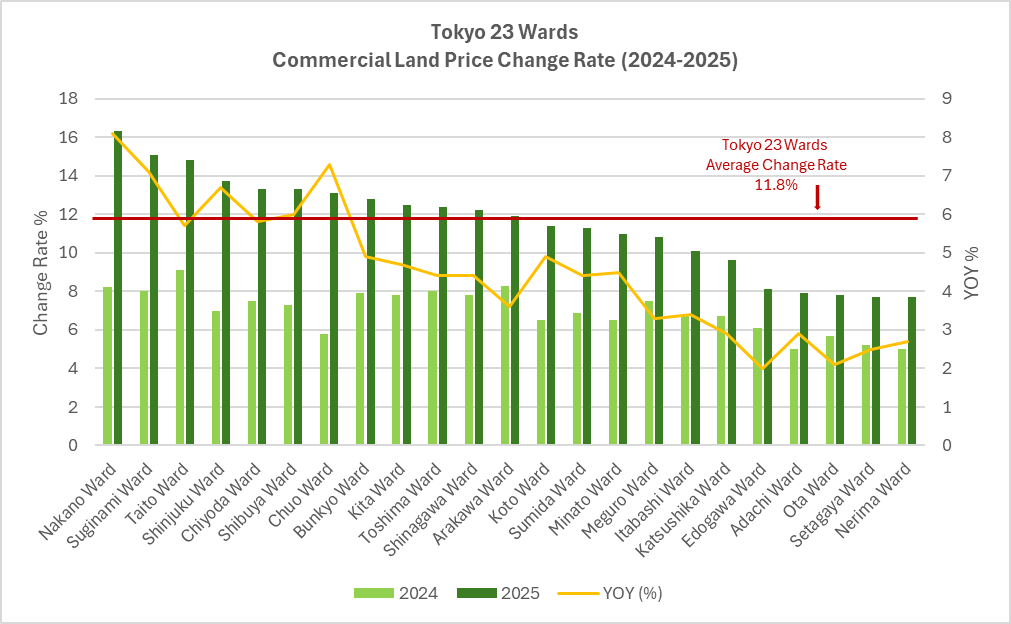

- Top Increases: The highest commercial land price increases were observed in Tokyo (10.4%), with the 23 wards of Tokyo leading at 11.8%.

Recent Drivers & Future Expectations:

- Key Drivers: The main factors behind the ongoing land price increases include strong demand in urban centers, the development of premium commercial spaces, and improvements in infrastructure. These trends are particularly evident in Tokyo, Osaka, and regions with strong tourism or redevelopment activity.

- Regional Disparities: While Tokyo and Osaka continue to experience sharp increases, Nagoya’s growth has slightly slowed. However, regional areas benefiting from tourism and the rise of e-commerce industries continue to show upward momentum.

- Outlook: Looking forward, land prices are expected to continue rising in major metropolitan areas with ongoing redevelopment, strong demand for residential and commercial properties, and robust tourism. Regional variations will persist, with some areas seeing more moderate price changes.

■ Strong Growth in Land Prices Across Tokyo’s 23 Wards: A Closer Look at Trends and Key Areas

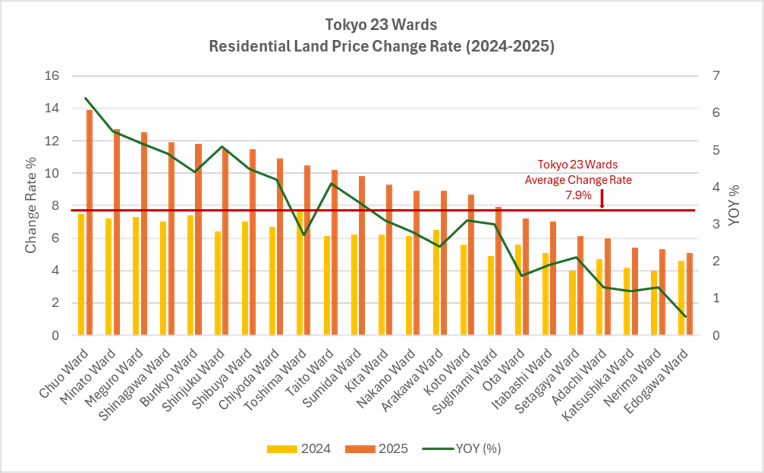

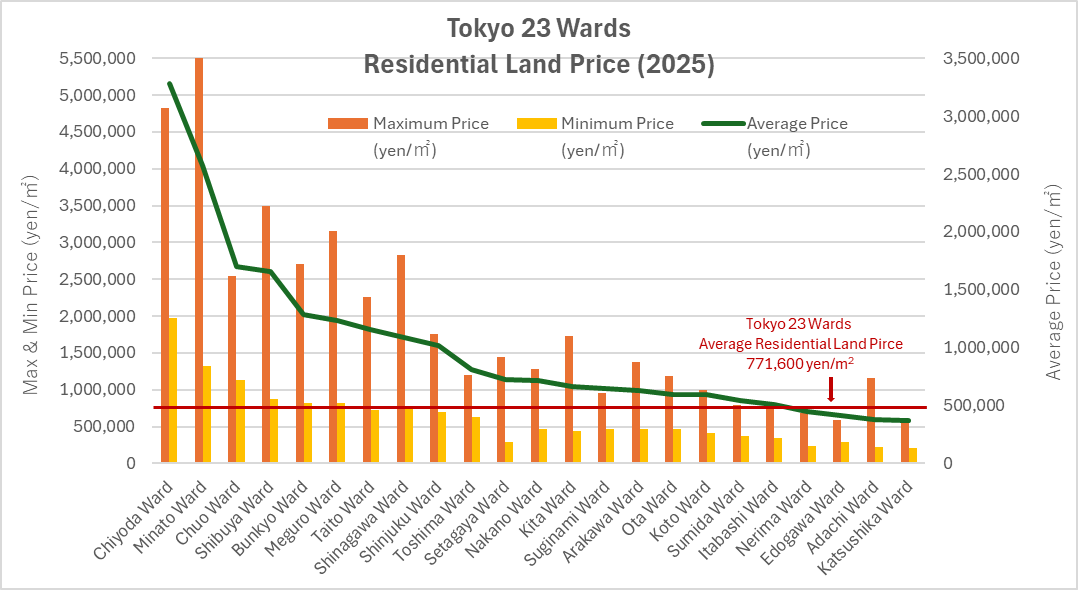

Residential land prices in Tokyo’s 23 wards increased by an average of 7.9% year-over-year, while commercial land prices saw an impressive rise of 11.8%. This represents a notable acceleration compared to the previous year, when residential and commercial land prices grew by 5.4% and 7%, respectively. The 2025 data further highlight the strength of Tokyo’s real estate market, as 10 of the 23 wards experienced double-digit growth in residential land prices, and 17 wards saw double-digit growth in commercial land prices.

Among the 23 wards, the top performers for residential land price growth were Chuo Ward, Meguro Ward, and Minato Ward. On the commercial side, Nakano Ward, Suginami Ward, and Taito Ward led the growth, reflecting the ongoing strength and competitiveness of Tokyo’s real estate market. This surge in land prices in 2025 marks the highest growth in recent years, underlining the sustained demand for both residential and commercial properties in Tokyo.

The average price of residential land in the 23 wards stands at ¥771,600 per square meter. Leading the pack is Chuo Ward, where the price reaches ¥3,282,900 per square meter, driven by its prime location and high demand. Following closely are Minato Ward, Chiyoda Ward, Shibuya Ward, and Bunkyo Ward, each characterized by their central locations, excellent infrastructure, and proximity to key business, cultural, and leisure hubs. These areas continue to attract strong demand from both domestic and international buyers, solidifying their status as highly desirable locations for living and investment.

Interestingly, although Adachi Ward did not rank among the top 10 for overall growth, its Ayase area experienced a notable price surge, catching the attention of investors and homebuyers alike. This unexpected rise in Ayase has become one of the highlights in Tokyo’s real estate landscape, drawing interest for its potential and increasing value.

■ The Charm of Ayase area in Adachi Ward: A Blend of Tradition and Modernity

Ayase Station, served by JR Joban Line and the Chiyoda Line, retains a nostalgic charm with its traditional eateries, shops, and supermarkets situated beneath the elevated tracks. The surrounding neighborhood is a mix of older homes and classic izakayas, offering a true downtown Tokyo atmosphere.

The Ayase area has seen a notable shift in housing demand, driven by rising prices in more central districts like Chuo and Shibuya. As rents in these areas became increasingly unaffordable, many people, including those looking for more affordable living options, have expanded their search to more suburban areas like Ayase. Over the past few years, the cost of housing in Ayase has been steadily increasing, with prices of single-family homes rising significantly, making homeownership more difficult for residents. Despite this, the area continues to attract individuals seeking more reasonably priced options compared to central Tokyo.

The Rise of Ayase: Growing Demand and Real Estate Potential

Recently, the real estate market in the Ayase area has seen a remarkable rise, with land prices in Ayase 1-chome increasing by 16.6%, from 926,000 yen to 1.08 million yen per square meter. This surge has placed Ayase among the top three residential areas in Tokyo’s 23 wards. The ongoing development of a 32-story tower condominium near the station, with units expected to be priced over 100 million yen, further emphasizes the area’s growing appeal.

Historically overshadowed by its more well-known neighbors, the areas of both Kita-Senju and Kameari, the area of Ayase has begun to attract attention as central Tokyo prices have surged. The Tokyo Metro Chiyoda Line provides a quick 20-minute commute to the Otemachi area, close to Tokyo Station, making Ayase an increasingly attractive option for commuters. The area’s affordability, combined with its peaceful residential environment, has particularly appealed to families. As a result, properties near Ayase Station tend to generate high demand as soon as they are listed, highlighting the area’s growing potential for both homebuyers and investors.

■ The Rising Appeal of Outer Tokyo Areas in Real Estate Investment

Ayase is not alone in experiencing a surge in residential land prices. Other peripheral neighborhoods are also showing significant growth. For example, Akabane 1-chome in Kita Ward ranked fourth, while Takinogawa 5-chome in the same ward placed ninth in the rankings. This reflects a broader trend of rising interest in areas other than central Tokyo, where property prices remain more affordable compared to the city center.

The increase in demand for these areas is largely driven by the continued high cost of housing in central Tokyo. As prices in key districts such as Shibuya and Minato rise, more buyers are seeking alternatives in outer districts with better affordability and strong commuting links. With access to the central business district via convenient transportation, these outer areas are becoming increasingly attractive to both homebuyers and investors.

As demand for more affordable housing options continues to grow, areas like Ayase and other peripheral neighborhoods are expected to see sustained growth in property values and increased development. This shift offers opportunities for real estate investment in regions that were once overlooked but are now emerging as desirable locations for residents seeking balance between convenience and cost-effectiveness.

~ END ~

※Source: All the above tables and graphics are generated from the data of the Ministry of Land, Infrastructure, Transport and Tourism, Japan.

If you would like to learn more about investment properties in Japan, please click here. >

・Recommended Articles

Exploring Tokyo2022.4.25

Basic Information of Tokyo Area

Tokyo is one of the metropolitan cities in the world. As a capital city of Japan, the city tops the population […]

Property Knowledge2022.9.22

A guide for foreigners buying real estate in Japan.

Topic: Property Information Post on 2022.9.22 Basically, the procedure of buying real estate in Japa […]

Property Knowledge2022.7.4

NEW OR OLD? Which one is better for property investment in Japan?

Is it better to invest in a new construction property or a second-hand one?What are the factors affecting the […]

Market Information2022.7.12

What is the most updated land value in Tokyo and the changes in 5 years ?

In Japan, property prices are decided by both land and buildings value. Although there is a tendency that the […]

Subscribe for Latest Property News

Don’t miss out! Subscribe now to stay tuned to the latest trends, news, and listings in Japan’s real estate market.